Unlocking MENA's Tech Potential May Require Bridging a $20 Billion Growth Funding Gap

15 November 2023•

Over the last 5 years, a whirlwind of early-stage investments has catapulted MENA’s tech ecosystem into the global tech arena. Despite being poised for a great boom with Dubai’s ambitions to crown 30 startups as unicorns by 2033 and Saudi Arabia launching the the “Saudi Unicorn Program” under the National Technology Development Program (NTDP), a striking conundrum seemingly looms ahead to achieve this.

In their latest whitepaper, STV, the MENA region’s largest privately-held venture capital firm, has projected a US $20 billion funding gap for growth stage investments, threatening MENA’s startup ecosystem ambitions in the coming years. Here's what you need to know.

MENA’s Startup Ecosystem Today

MENA’s VC sector witnessed a watershed moment in 2018, marked by the active support of technology companies by institutional investors. Half a decade later, this surge has translated into the funding of over 2,000 startups, amassing a staggering $9 billion in equity investments.

Today, around 220 companies have reached the growth-stage phase, armed with Series A or later funding rounds. Though growth-stage ventures pose a lower risk profile and often offer substantial returns within a relatively short span of 2 to 5 years, they demand ten times more capital than their early-stage counterparts. High risk, high reward.

Thus, MENA teems with potential as over 220 startups in eCommerce, FinTech, and Logistics – among other sectors - are now leveraging the region's vast Total Addressable Markets (TAMs). Several of these companies have already publicly announced their intentions to prepare for IPOs—a testimony to the MENA region’s recent surge in tech acquisitions and IPOs, reflecting the region's maturing technology landscape.

Short of $20 Billion Dollars

There’s a shadow lurking on the horizon, however, which poses a risk to the sustainability of this momentum. STV makes it abundantly clear—MENA needs more VC funds focused on growth stage investments, and government intervention is the key.

The average assets under management (AUM) of growth-stage VC funds are significantly larger than early-stage funds, which translates to the need for funding from institutional giants like sovereign wealth funds and pension funds. These institutional investors, however, lean towards established funds with proven track records in terms of exits and returns, and that’s where STV says the trouble lies.

MENA's growth-stage funds lack this critical track record, given the region's tech ecosystem’s relative nascency. Here, the report underscores the crucial role of government intervention, which becomes necessary to bridge the funding gap in the growth-stage sector and create a track record that entices private investors to commit their capital, thereby ensuring self-sustainability in MENA’s tech ecosystem.

As an investor in this paradoxical situation, the choice is yours, but the stumbling block currently present in MENA is significant and the financial equation remains. STV projects that $25 billion in growth-stage funding is needed in MENA over the next five years to unleash the region's full potential. This estimate takes into account GDP size and ratio, the emergence of potential MENA Unicorns, and the graduation of ventures across the funding funnel.

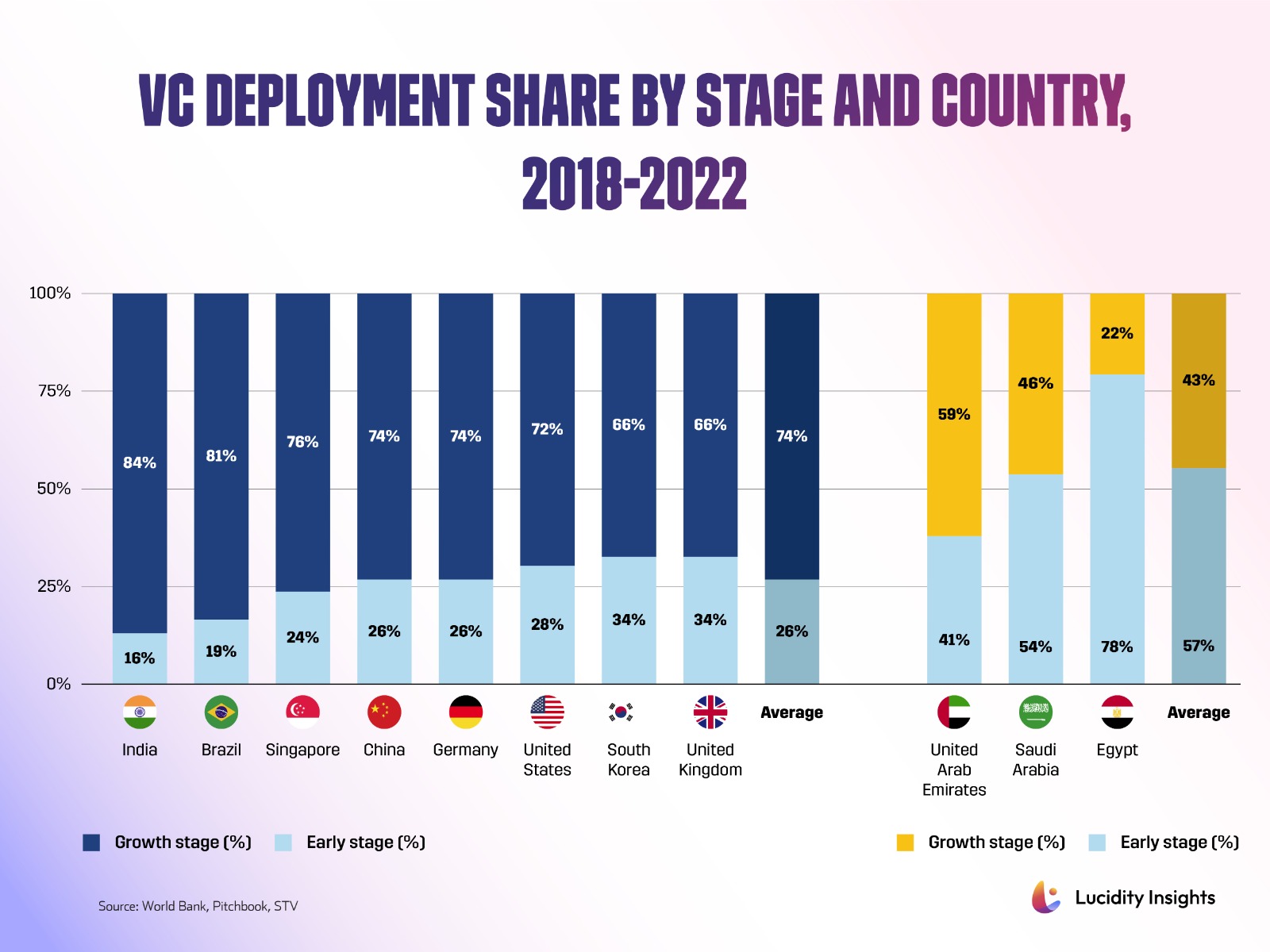

Graph: MENA (ex. Israel) VC Funding still Skewed Towards Early Stage Startups vs Global Averages

Though 59% of UAE startup fundraising goes towards growth stage startups, this is still well-below the global average of 74%. The UAE's startup ecosystem is past the infancy or nascent stage and is now well developed over the past 15-20 years. The gap is even larger in Saudi Arabia, and Egypt, where only 46% and 22% of funding, respectively, is going towards growth stage startups.

The stark reality that STV points out is that the MENA region currently has only $4.2 billion in "dry powder" available for its growth-stage companies, resulting in a funding gap exceeding $20 billion.

The VC Winter Impacting MENA

The report also reveals a 42% decrease in funding and a 55% decline in the number of active investors in the first half of 2023 as international investors, who once flocked to the region, have now dialed down their participation. Local investors, too, are grappling with their own set of challenges, primarily liquidity constraints that limit their ability to bridge the funding gap and make substantial investments.

The message is loud and clear: this $20 billion funding gap cannot be ignored. It calls for specialized local investors and government intervention to overcome and secure the continued growth of MENA's tech ecosystem.

Public Funds of Funds like SVC and Jada are advised to elevate their contributions to growth-stage funds, potentially reaching $100-300 million per investment. Sovereign Wealth Funds are encouraged to provide larger, more SWF-compatible allocations to growth-stage funds, fostering direct collaboration with VC investors for mutual benefit.

Moreover, the report highlights the untapped potential of pension funds in the GCC region to invest in MENA VCs, even with minimal allocations, which could significantly impact the VC industry. STV does have a few suggestions in their whitepaper though, starting with recommending channeling public funding into existing regional growth-stage VCs, regional early-stage funds for an organic transition, and motivating global growth-stage VC funds to establish a permanent presence in MENA, contributing expertise and potential Foreign Direct Investment.

MENA's tech future stands at the crossroads, brimming with potential where the funding gap is addressed. The sooner the better, allowing MENA to cement its position as a global tech powerhouse and the breeding ground for innovation that we've always known it to be.

.jpg&w=3840&q=75)

%2Fuploads%2Fmena-sustainability-innovation%2FMENA-Sustainability-Innovation-cover.jpg&w=3840&q=75)