Saudi’s Young & Tech Hungry Consumer

23 March 2023•

We spoke to dozens of the most active investors and VCs in the Kingdom as well as the region to ask them “what’s driving the start-up ecosystem in Saudi Arabia today?” The response was unanimous: Saudi’s tech-savvy consumer base with favourable consumer spending behaviour and a willingness to pay for value-add services. Couple that with the scalability of a market with a population of 35 million, and you get a magical combination for startup success.

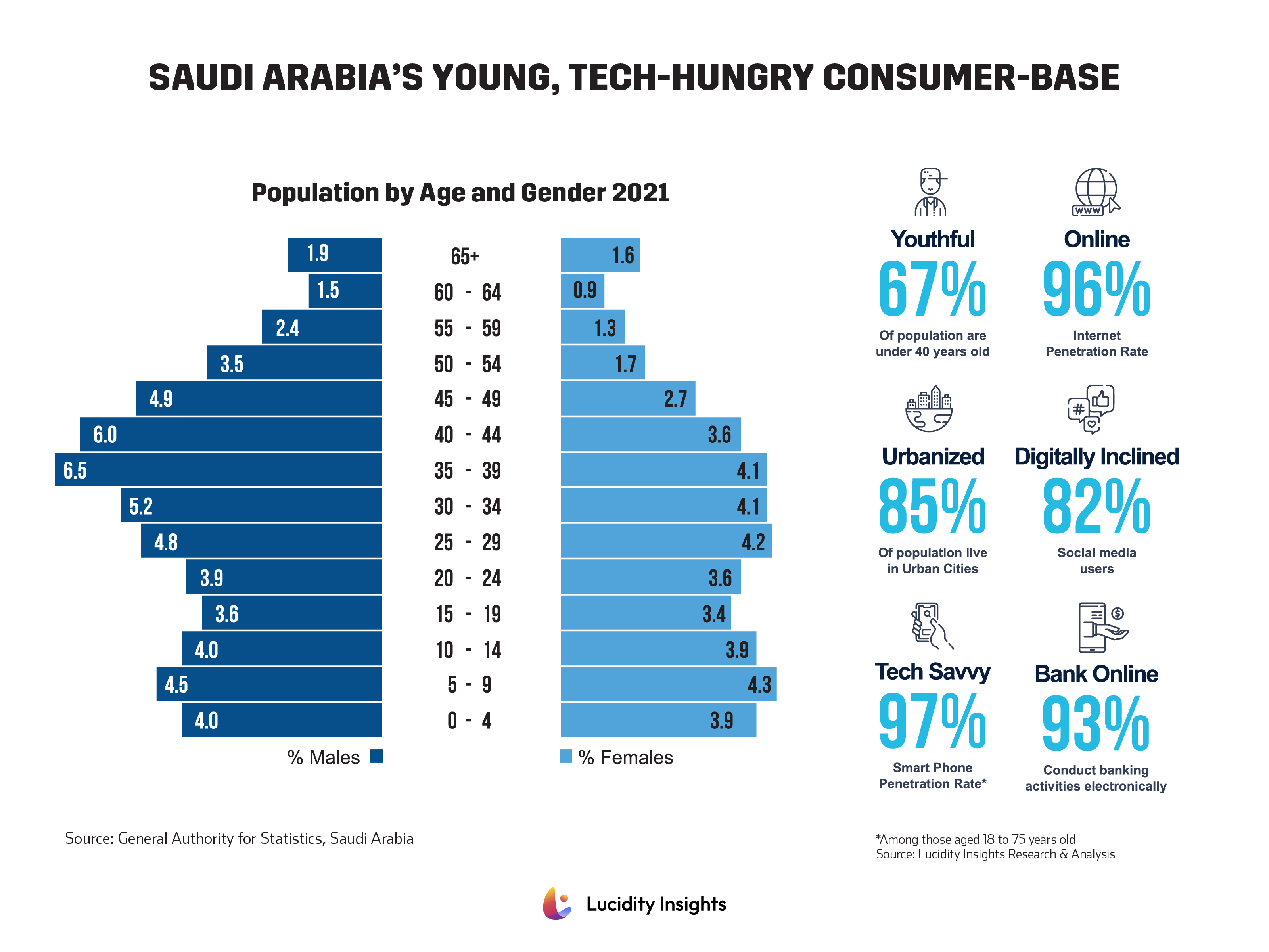

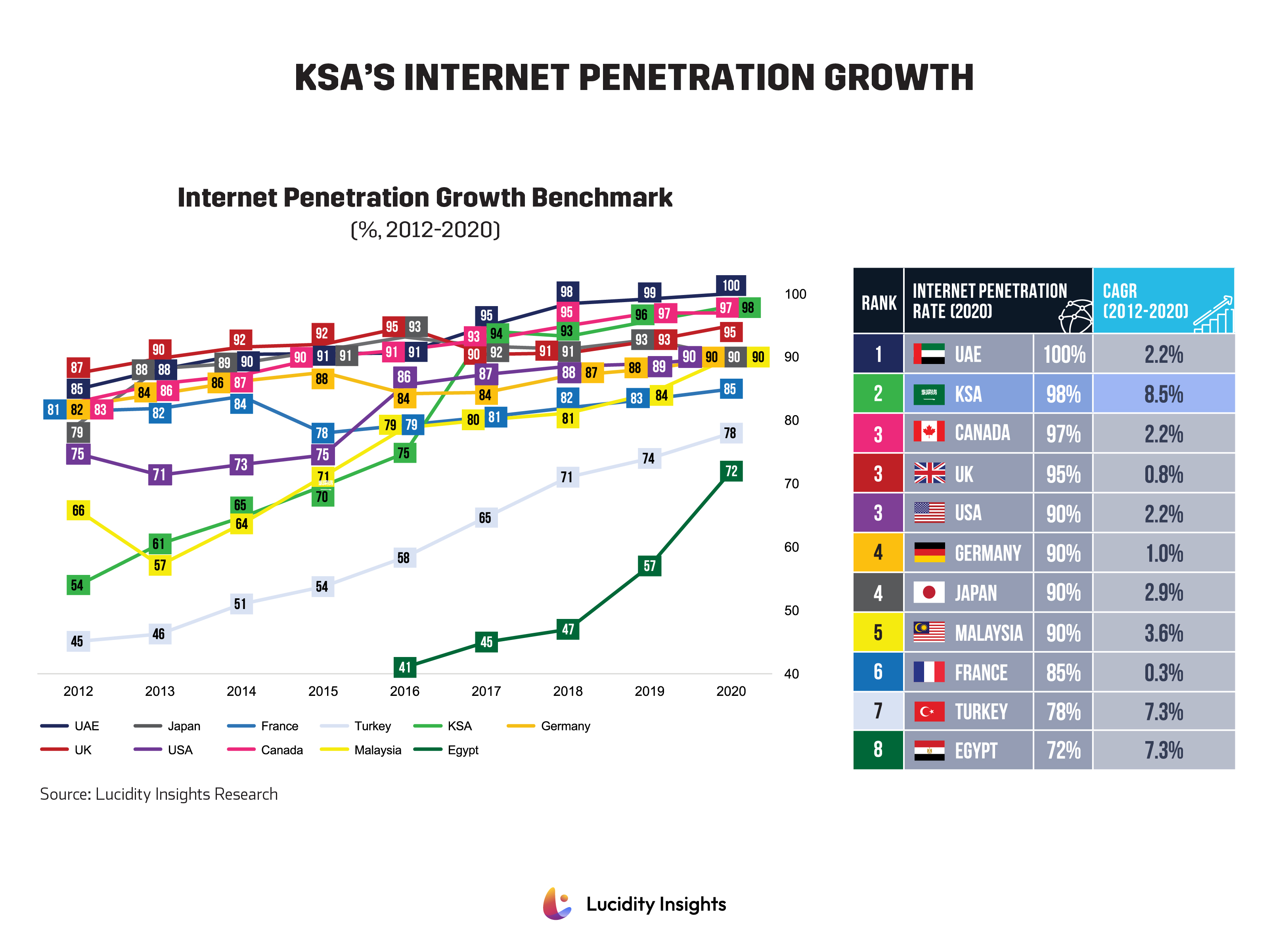

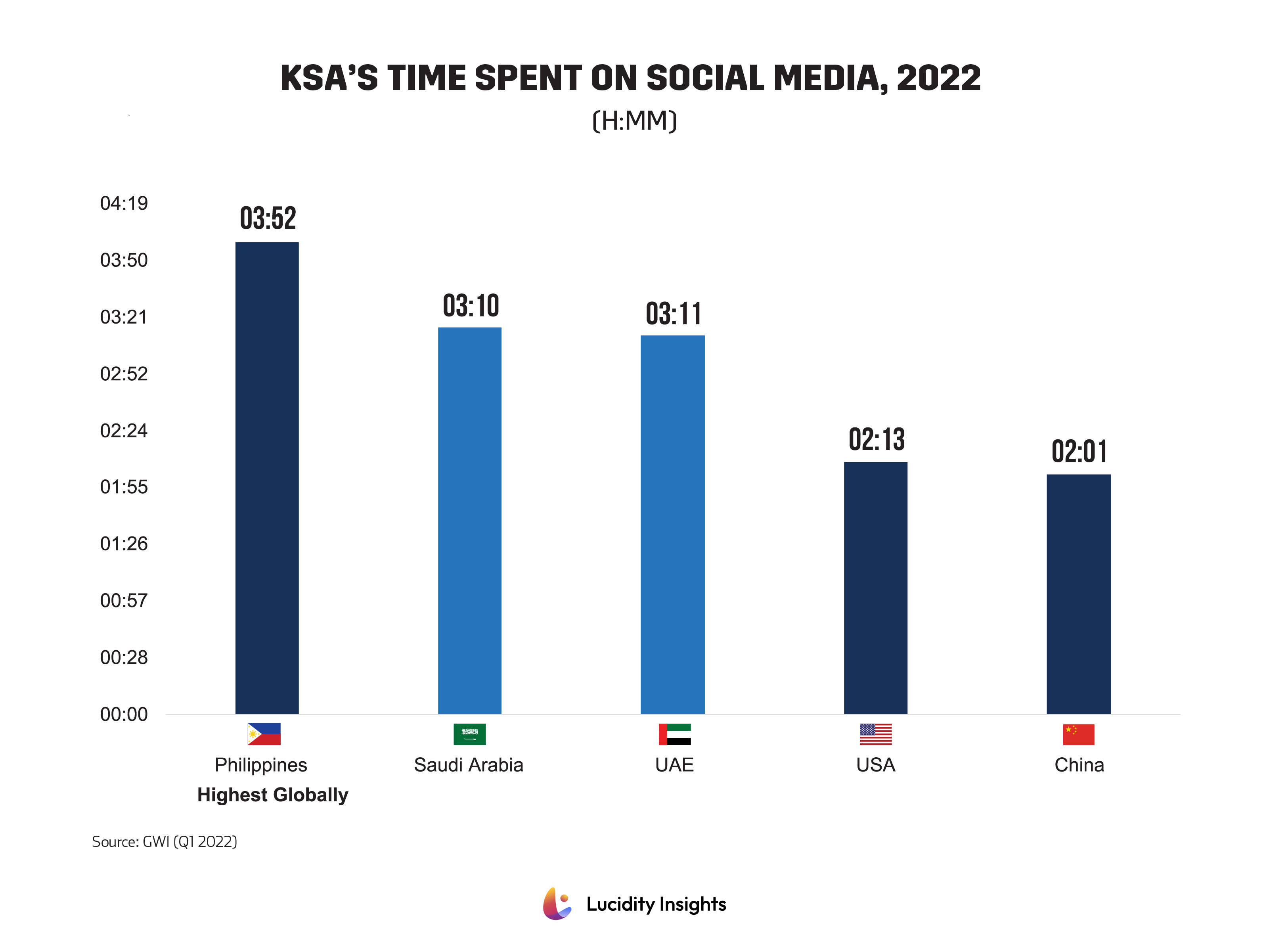

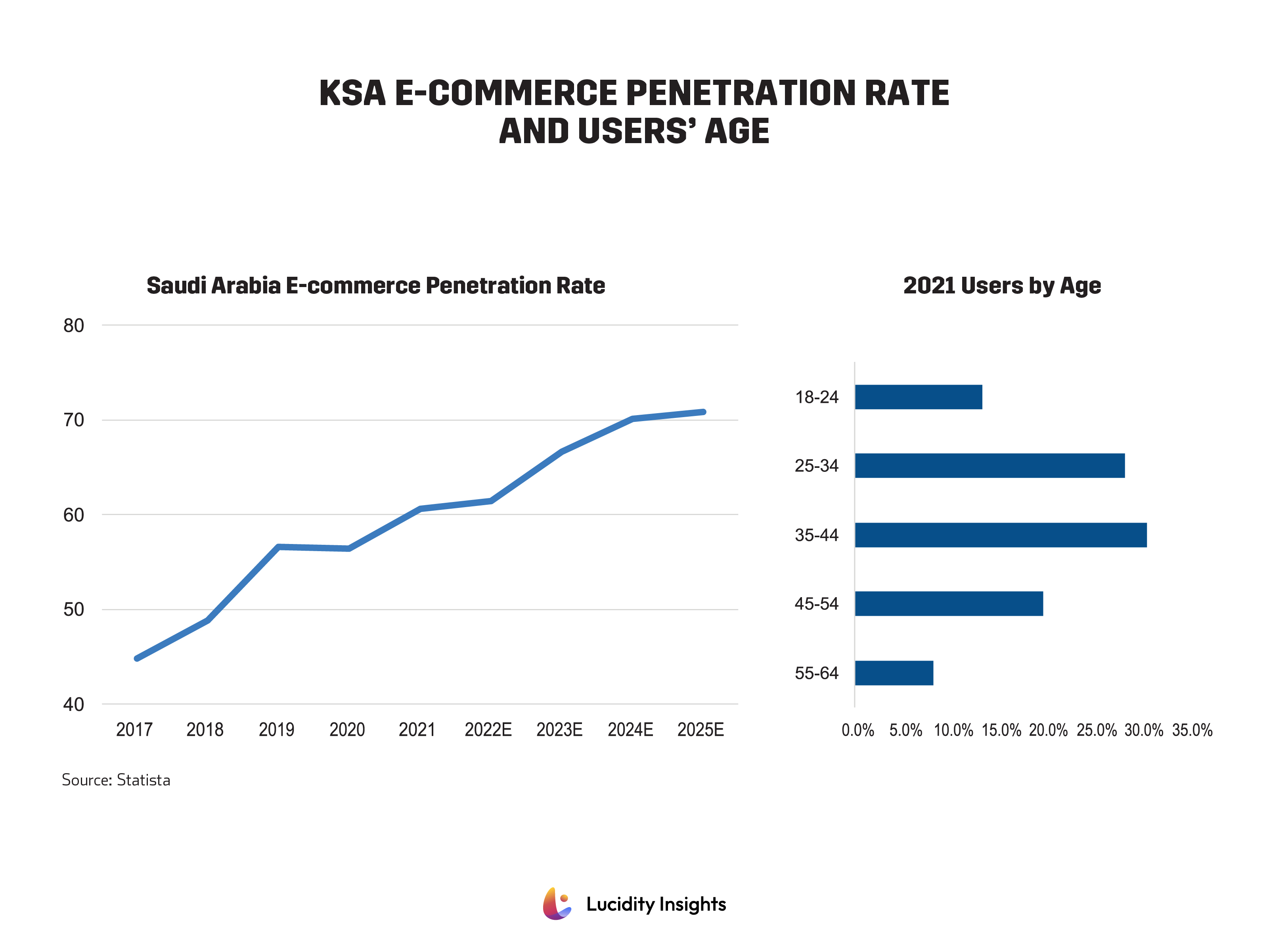

Saudi Arabia is a large emerging market consisting of a young, tech-hungry consumer base with great infrastructure in place to satiate that appetite. In the past 10 years Saudi Arabia has dramatically improved its internet penetration rates, growing from 54% in 2012 to reach 98% today. This makes internet penetration higher in Saudi Arabia than in many other leading economies around the world like the UK (95%) and the USA (90%). In 2021, the Kingdom ranked 7th globally for the fastest mobile internet speed, giving way to even higher smartphone penetration rates. Perhaps this speaks to Saudi’s love of social media. 79% of the Saudi population are social media users and spend on average 3 hours and 16 minutes on social media platforms, signifying an online presence higher than that of leading e-commerce markets.

Watch Video: The Tech-Savvy Youthful Population Is Driving E-Commerce Growth In The Kingdom

Saudi Arabia’s Attractiveness for Consumer-Tech Startups

Speaking with many startup founders, venture capitalists, eCommerce and retail entrepreneurs, they tell us that Saudi’s strong and consistent consumer-base is what attracts startups from across the region. Saudi Arabia has the largest population in the Gulf, being home to 35 million people. Saudi Arabia relies less heavily on expats compared to neighbouring UAE, 39% of Saudi’s 35 million are expats, while 91% of the UAE’s population are non-Emirati. This means that the Saudi population is more homogenous, less transient, and - according to some investors - more reliable for retail, F&B and consumer-oriented businesses. Investors comment on how summers can be a “dead period” for consumer-tech startups in Dubai while expats escape on summer holidays, while revenues remain a bit more consistent in Saudi Arabia in comparison.

Watch Video: Saudi Arabia is the GCC’s most attractive market for consumer-tech start-ups

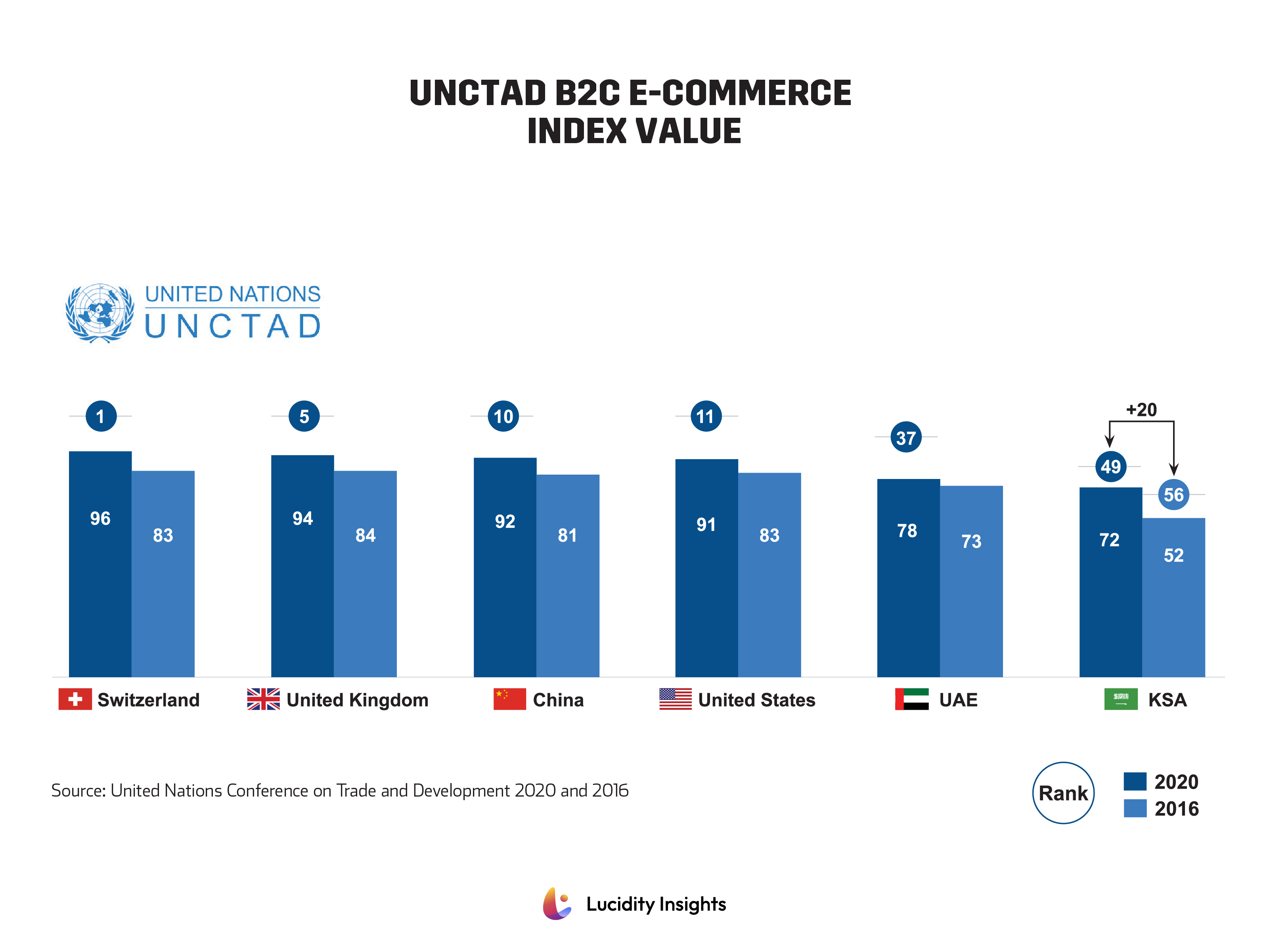

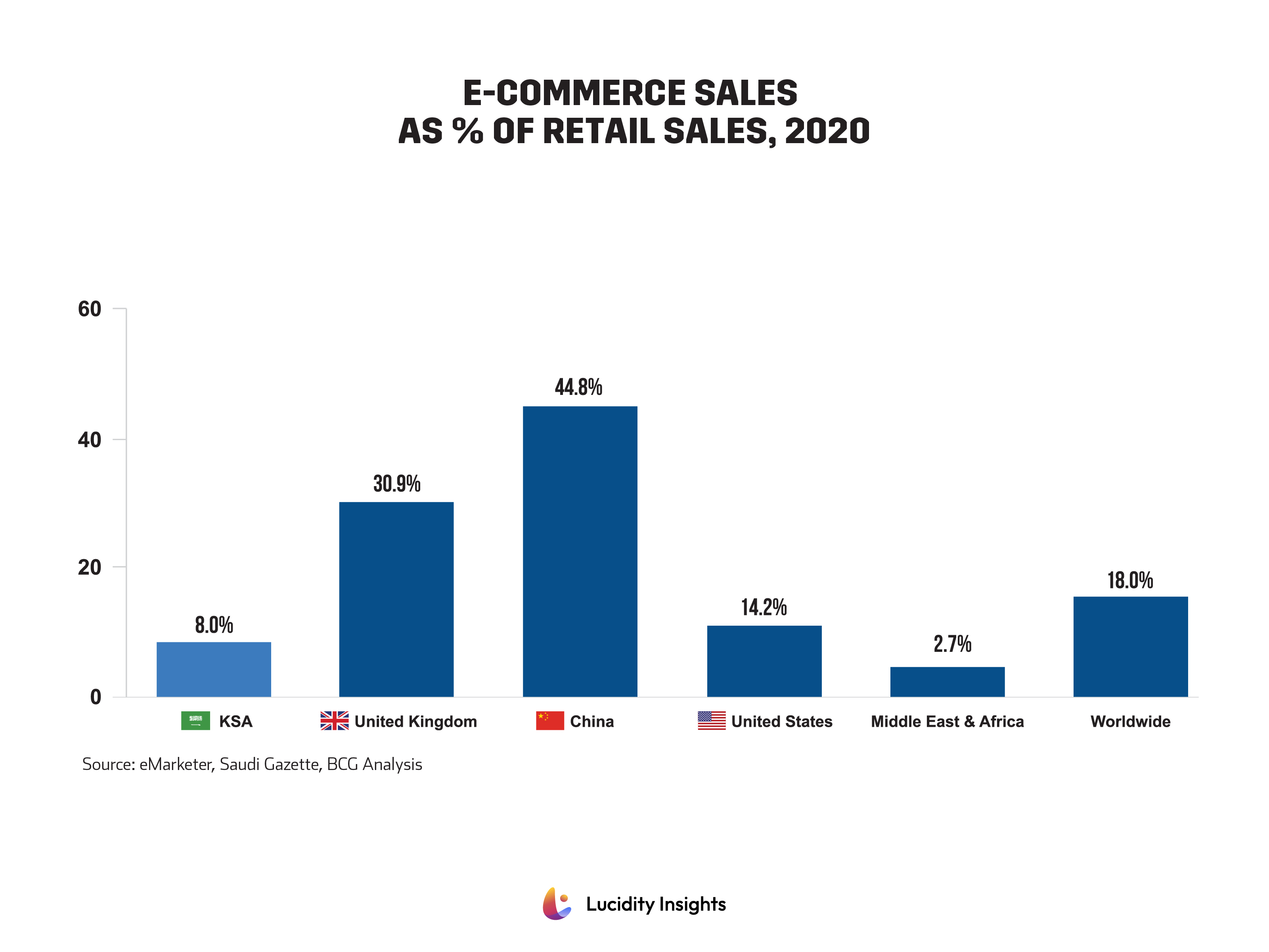

The UNCTAD’s B2C e-commerce index value measures a country’s competence and readiness to support online shopping. Saudi Arabia ranked second in the region after UAE in 2020 and has jumped 20 points since 2016, showing tremendous improvement compared to leading countries. E-commerce also relies on postal development and Saudi Arabia ranked 55th out of 168 countries in the Postal Development Report 2021 up from 73rd in 2018. In 2020, the Kingdom’s e-commerce sales were only 8% of total retail sales, which is much higher than the Middle East & Africa average (at 2.7%), but when compared to more mature markets like the USA (14%), the UK (31%), and China (45%), it indicates substantial room for growth.

Read Next: Who Are the Key Stakeholders and Supporters of Entrepreneurship in Saudi Arabia?

Learn more about the successful and the emerging Saudi’s startup and its ecosystem, in the most comprehensive report on the topic to date, The Evolution of Saudi Arabia's Start-Up Ecosystem 2010-2022.

%2Fuploads%2Fsaudi-venture%2Fcover2.jpg&w=3840&q=75)